BUSINESS ASSISTANCE RESOURCES:

SITE SEARCH +

OTHER SERVICES

INCENTIVE

PROGRAMS

FEATURED

PROPERTIES

ELECTED OFFICIALS /

CHAMBERS

Site Search + Other Services

SDNEDC can help you carry out real estate searches throughout San Diego County.

We can conduct these screens anonymously for you and pre-vet sites or connect you with local economic developers in specific cities. We are able to engage partners to identify locations that may not yet be listed on real estate search engines. We can then work with you to identify the key actors involved in permitting and regulatory matters to help facilitate your investment into North County.

Incentive Programs

SDNEDC is here to help your business access state, local, and federal incentive programs.

For help applying to any of these incentive programs, please contact us directly to schedule a consultation appointment.

California Partial Sales Tax Exemption for Manufacturing and R&D Equipment:

A tax exemption reduces the amount of tax paid at the time of purchase. This sales tax exemption applies to the state portion of sales tax currently at 3.9375%, reducing the total sales tax paid in North County from 7.75% to 4.8125% on qualified property.

According to the Board of Equalization (BOE), a North County manufacturer must meet specific criteria to be eligible for the tax exemption, and should provide a partial exemption certificate (or equivalent information) to the vendor at time of purchase (REFERENCE)

California Partial Sales Tax Exemption for Construction and Tenant Improvements:

Qualified purchases made under construction contracts for tenant or infrastructure improvements are also eligible for the same partial sales tax exemption of 3.9375%.

For example, qualified purchases include special purpose buildings and foundations used as an integral part of the manufacturing, processing, refining, fabricating, or recycling process, or that constitute a research or storage facility used during those processes, and qualified materials and fixtures.

When doing tenant or infrastructure improvements, Construction Contractors will use BOE FORM 230-MC

California Competes Tax Credit:

California Competes Tax Credit is an income tax credit available to businesses that want to come to California or stay and grow in California.

This tax credit is a negotiated credit, meaning the State, economic developers, and private sector businesses will submit an application that assesses the costs and benefits of each business expansion. There will be an estimated $200 million of tax credits available per year to assist in creating and maintaining jobs in California. The SDNEDC staff can help you submit the online application.

To learn more about the Cal Competes program, the timelines for the application cycle, and how to maximize your company’s chances of winning a grant click here. Please note that SDNEDC fully expects the program to continue into 2021. However, the new timelines for the program have yet to be announced pending the adoption of the state’s 2021-2022 budget.

Research and Development (R&D) Tax Credits: Federal and State

Each year, more than 12 billion dollars in Research & Development Tax Credits are funneled back to US businesses at the federal level, and the tax credits are also available in California. Companies across numerous industries can qualify for the R&D incentive as long as the companies have engaged in activities that result in a new/ improved product (quality, reliability, performance, feature sets, etc.), or in a new/improved process.

San Diego Gas & Electric Economic Development Rate:

FORTHCOMING

California Alternative Energy and Advanced Transportation Financing Authority (CAEATFA):

The CAEATFA is providing a sales and use tax exclusion (full rate, including local and district taxes) on qualifying property that is used in the design, manufacture, production, or assembly of “advanced transportation technologies or alternative energy source products, components, or systems,” or “clean technology”.

The tax exemption takes place at the time of the qualified equipment purchase. Before one is able to make tax exempt purchases of clean-tech qualifying equipment, they must get their application approved by the CAEATFA.

California Alternative Energy and Advanced Transportation Financing Authority (CAEATFA):

The CAEATFA is providing a sales and use tax exclusion (full rate, including local and district taxes) on qualifying property that is used in the design, manufacture, production, or assembly of “advanced transportation technologies or alternative energy source products, components, or systems,” or “clean technology”.

The tax exemption takes place at the time of the qualified equipment purchase. Before one is able to make tax exempt purchases of clean-tech qualifying equipment, they must get their application approved by the CAEATFA.

California Employment Hiring Credit:

This program replaced the CA Enterprise Zone Tax Credit. It is not as robust as the Enterprise Zone program but is worth considering. Eligible businesses could generate up to $112,000 in tax credits per year from this program by hiring 10 new qualified employees.

Foreign Trade Zone:

Serving qualified sites within North County, this extension of the U.S. Foreign-Trade Zone (FTZ) program offers international traders, importers and exporters outstanding opportunities to take advantage of special customs privileges.

These incentives can lower barriers to trade, improve cash flow and enhance your company’s profits while giving you a competitive edge in the global marketplace.

Recycling Market Development Zone:

The Recycling Market Development Zone (RMDZ) is a California state program aimed to simultaneously reduce landfill waste and encourage manufacturing.

North County is one of several designated RMDZs in the state of California, and as a result, North County businesses that can demonstrate that they are recycling paper, plastic, glass and/or organic material are eligible for low-interest loans and technical assistance.

America’s Job Center of California:

The America’s Job Center of California (AJCC), San Diego, works with local with local businesses offering a variety of services from pre-screening candidates for open positions, to offering interview facilities and support services for job seekers.

All services at the AJCC are offered to businesses and job seekers FREE of charge, and tax credits and wage subsidies may be available for employees hired through AJCC. Participation in these workforce development programs can mean a significant return to your business, and the SDNEDC is happy to introduce local companies to the center.

Work Opportunity Tax Credit (WOTC):

WOTC is a federal tax credit for companies who hire new employees from certain target groups who have consistently faced significant barriers to employment.

The maximum tax credit ranges from $1,200 to $9,600, depending on the employee hired. The Veteran Opportunity to Work (VOW) to Hire Heroes Act of 2011 extended and expanded the WOTC Qualified Veterans target group.

College Access Tax Credit (CATC):

provides a tax credit to taxpayers and businesses who contribute to Cal Grants, the State of California’s largest source of educational financial aid. The credit can be used to offset or reduce taxes. Cal Grants provide aid to in need California undergraduates, vocational training students and those in teacher certification programs. These grants help California students achieve their higher education goals.

The Business Energy Investment Tax Credit (ITC):

A Department of Energy tax incentive that provides rebates to businesses when they use alternative energy, including solar.

Opportunity Zones:

Provide investors tax incentives to invest in low-income census tracts by allowing them to defer tax on capital gains and decrease taxes on potential future gains.

The Work Opportunity Tax Credit:

is a federal income tax credit incentive provided to private sector employers. An employer may be eligible for WOTC when they hire from certain target groups of job seekers who face employment barriers.

City of Vista Facade Improvement Program:

The Facade Improvement Program grants businesses in and near the downtown area, up to $15,000 to assist with exterior design upgrades.

Please note, businesses must apply and receive a Commitment Letter from the City prior to starting construction in order to be eligible.

Featured Properties

SDNEDC features a rotating list of properties available for purchase or lease from throughout North County.

To inquire about having a property listed on these pages please email a request to info@sdnedc.org. First preference is provided to SDNEDC investor companies and after that, properties whose occupancy will have a positive catalytic impact on the immediate surrounding neighborhood.

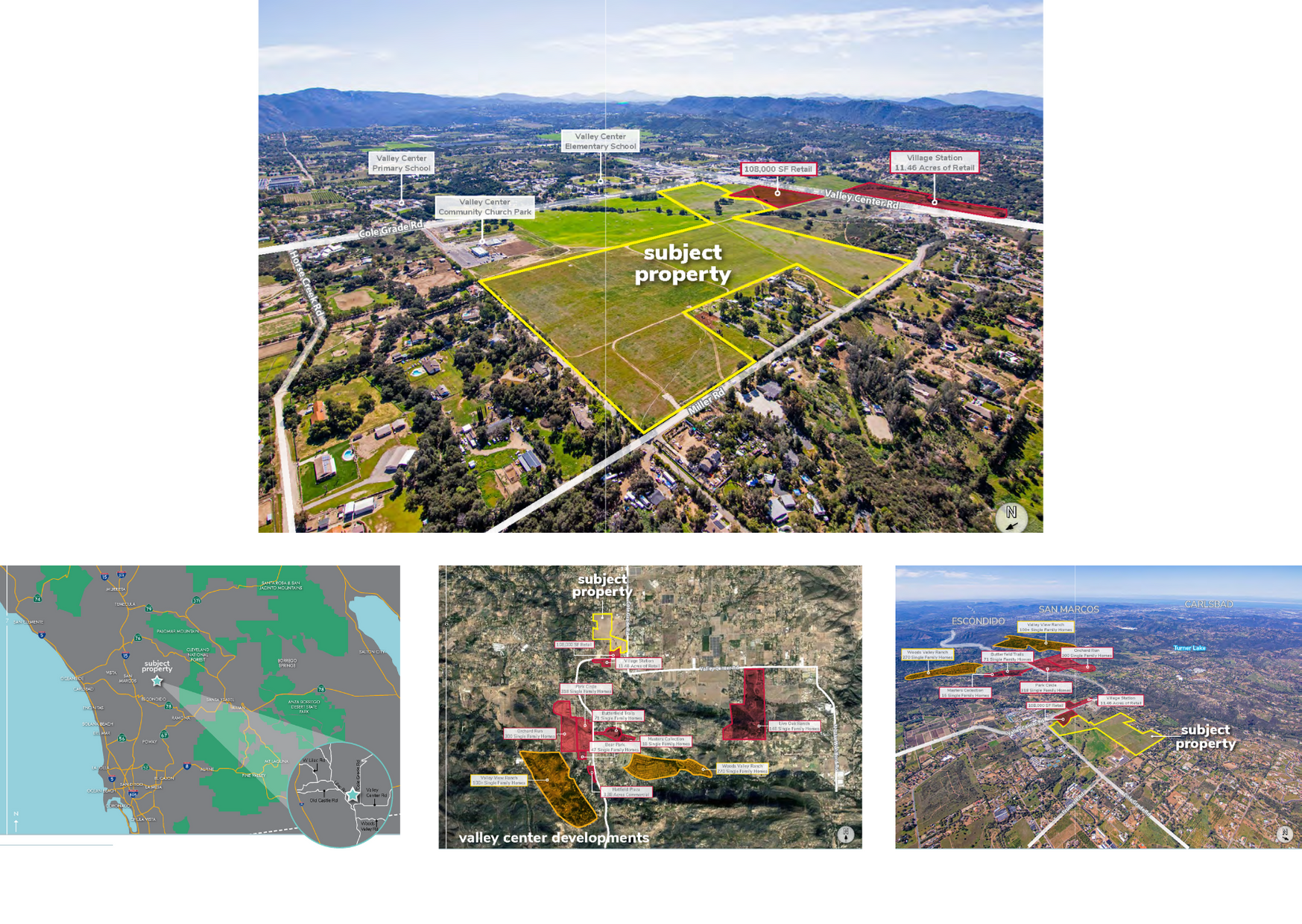

Valley Center Road & Cole Grade Road, Valley Center

Located within a growing community in Valley Center, this site is an excellent opportunity for a larger residential development. The property is part of North Village, sitting on approximately 84.7 acres, and is one of few locations designated for residential housing with various lot sizes. The property is zoned for as many as 611 dwelling units and provides an opportunity for a builder to sell homes under the FHA loan limit ($753,350). The property includes 115 sewer standby EDU’s and 400 sewer collection EDU’s.

For more information and pricing, please contact Matt Weaver at (760) 448.2458/ mweaver@lee-associates.com or Al Apuzzo at (760) 448.2442/ aapuzzo@lee-associates.com

5925 Farnsworth Court, Carlsbad

Positioned between College Blvd. and El Camino Real is a free-standing industrial building boasting 15,126 square feet with approximately 4,500 square feet of office space. The newly completely renovated Carlsbad Research Center building is slated to begin speculative creative, modern office improvements. This property sits on 1.07 acres and features two dock high positions, three-grade level doors, and 29 on-site parking stalls

For more information, please contact Ricky James at (760) 472.5620 or rjames@voitco.com.

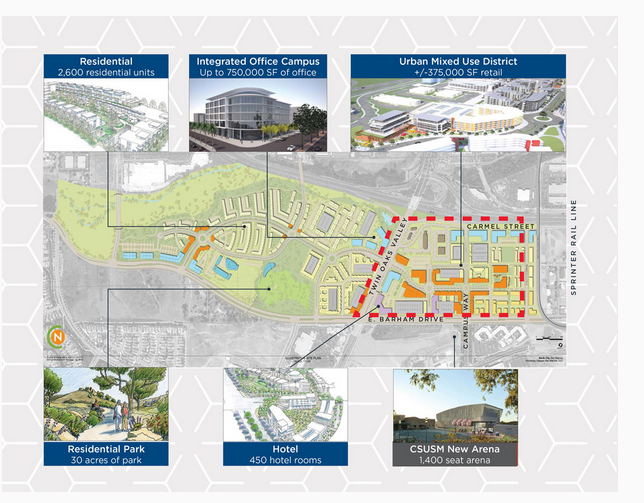

North City, San Marcos

North City in San Marcos continues to grow with the new CSU San Marcos Extended Studies building recently celebrating its topping off. With a variety of office leasing opportunities, the mixed-use master planned community is becoming one of North County’s premiere work, play, live neighborhoods.

For more information or to inquire as to leasing opportunities, please visit this link.

Economic Development + Chambers of Commerce

Economic Development Directors and Chambers of Commerce often can provide services and support that expanding businesses find useful. SDNEDC encourages you to forge partnerships with these groups. Should you need assistance or feel an introduction would be useful, please contact Erik Bruvold at ebruvold@sdnedc.org.

ECONOMIC DEVELOPMENT DEPARTMENTS

CHAMBERS OF COMMERCE

- San Diego North Chamber of Commerce

- Escondido Chamber of Commerce

- San Marcos Chamber of Commerce

- Vista Chamber of Commerce

- Oceanside Chamber of Commerce

- Carlsbad Chamber of Commerce

- Solana Beach Chamber of Commerce

- Encinitas Chamber of Commerce

- Del Mar Chamber of Commerce

- Poway Chamber of Commerce

- Fallbrook Chamber of Commerce